This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

News

4 Global Trends Every Manufacturer Must Understand

The world is changing, and four big trends paint a picture of where the people and the purchasing power are today – and will be in 5, 10, and 20 years from now.

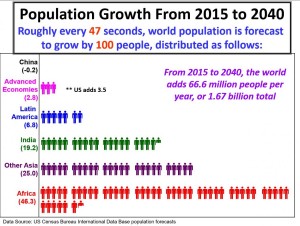

Jeffrey Rosensweig, a professor at Emory University’s business school, told The Vinyl Institute that the world’s population is exploding and the implications for business are huge. “Can you imagine a world with one and two-thirds billion more people?” he asked. Rosensweig noted that more and more people will be moving into the middle class, and he added, “There is going to be huge demand out there. Those who are very good at what they do? The world is going to be their oyster.”

Don’t sleep on the developing world.

Rosensweig highlighted economic trends in a presentation he made at the Vinyl Institute’s annual meeting in early November. Key among them: don’t sleep on the developing world.

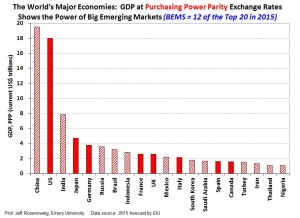

Rosensweig told the Vinyl Institute that “populous emerging markets have really emerged.” A look at the world’s major economies by GDP shows that the power has largely moved away from traditional developed economies to emerging countries.

Moreover, many of these same emerging economies are bases for U.S. manufacturing – highlighting the interconnectedness among the world’s major economic powers.

Another key to this shift is to look at which countries have the fastest growing economies. All three – China, India, and Indonesia – are in the developing world. Rosensweig noted that these emerging economies offer growing market opportunities for vinyl products and other U.S. goods.

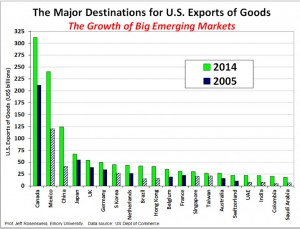

Proximity still matters in the export market.

Canada and Mexico remain the two largest export markets for U.S. goods. Proximity still matters. That said, Rosensweig pointed out that China has over the last decade become a major market for U.S. goods. Note other emerging markets, from Brazil and Colombia to Saudi Arabia and the United Arab Emirates, that are becoming markets to watch – and market to.

Pay attention to currency markets.

Rosensweig talked about the strengthening dollar and the weakening of foreign currencies. He observed that several currencies are losing value because they are so-called “commodity currencies” (e.g., China makes much of its money on copper; Russia on oil and natural gas). Overall, Rosensweig warned that, in the short term, U.S. exports are likely to be weaker as consumers’ purchasing power in some key countries is eroded by weak currencies.

Population growth only tells part of the story.

Projected population growth is stunning – and the estimates reinforce the current shift in economic power from developed countries to the developing world. But the overall numbers only tell part of the story. Of equal importance is where populations are aging (e.g., the U.S., China) and where they’re not (e.g., India). Countries with aging populations are likely to face both labor shortages and more-and-more consumers with dwindling buying power.

The Wall Street Journal recently put together an interactive look of the impact of demographics on the global economy. It’s worth exploring the data.